by Denae Luna | Sep 10, 2025 | Company News, Programmatic

In today’s fragmented digital advertising landscape, media buyers face a persistent challenge: how do you ensure your carefully crafted audience data actually reaches the right people through high-quality channels? Too often, sophisticated data activation strategies fall short when activated against subpar inventory and fraudulent traffic.

We’re excited to introduce our solution to this fundamental problem: the Curated Audience Network.

The Perfect Marriage of Data and Inventory

The Curated Audience Network ensures audience data is activated against validated, high quality inventory at scale. It is the yin to high quality data’s yang. This approach recognizes that effective digital advertising requires both components working in harmony—exceptional audience insights paired with premium, brand-safe environments where those insights can drive real results.

Why This Matters Now

The open web represents enormous opportunity, but navigating it effectively requires more than just good data or premium inventory alone. Media buyers need a solution that brings both together seamlessly, eliminating the guesswork and inefficiency that comes from managing these components separately.

Curation has opened the door to innovation on the supply side, closer to the vital signal that media buyers covet for targeting the right audience. Unfortunately, we live in an industry where a lot of undifferentiated data providers are hard for media buyers to keep up with and fraudsters continue to drain a tremendous amount of money from media budgets.

The Curated Audience Network addresses these issues by integrating the Population Science SupplyShield solution with advertiser first party data and a vetted network of best of breed data providers. This allows media buyers peace of mind when activating their own data or if they are in need of 2nd or 3rd party data sources we can match them with a high quality source.

Ready to Streamline Your Media Activation?

Whether you’re a media buyer looking to activate media more efficiently, a high quality publisher with scaled first party data, or a high quality data provider wanting streamlined distribution, the Curated Audience Network offers a comprehensive solution that benefits everyone through improved efficiency and quality.

Contact our team to learn more about how the Curated Audience Network can help you achieve more efficient, effective campaigns. To learn more about our launch partners click here.

The Curated Audience Network is now available through Population Science.

Learn More

by Denae Luna | Apr 17, 2025 | Digital Marketing, Programmatic

Download the pdf version of the Guide

Overview

When buying digital media most resources go into the inputs of the ad buying process (campaign strategy, creative, and platform). Most agencies and in-house teams do not have enough resources to take on the complex, downstream marketplace analysis and optimization that is required to run a truly efficient campaign.

Media buyers either add verification vendors or hope their platforms optimize their media marketplace for them. Unfortunately, those efforts are woefully inadequate. As validation vendors come up short, signals become more segmented, and third party data provide dubious value media buyers need to take a more active role in controlling the media they are buying.

This guide was created to help the programmatic ecosystem better understand curation/sell side decisioning and how it can help solve some of these challenging issues.

Topics Covered:

- How the open web became a nontransparent, chaotic mess.

- What is curation?

- What is curations role in creating and managing efficient media marketplaces?

- How your organization can get into curation.

The Open Web: Infinite Chaos

The open web was supposed to democratize access to media. It actually made digital media buying more complex creating massive inefficiencies along the way.

Key Issues With The Open Web:

- Too much inventory and too little bandwidth to process it all. This leads to largely arbitrary, algorithmic-based decisioning on bidstream traffic.

- Seemingly unlimited intermediaries across the supply chain providing (often) unknown value.

- Lack of bandwidth from buyers to truly analyze the value of the media they buy at scale.

- Lack of quality control when it comes to implementing IAB standards creating confusion.

- Rampant fraud and brand safety issues.

Why Is The Open Web So Complex?

Why Is The Open Web So Complex?

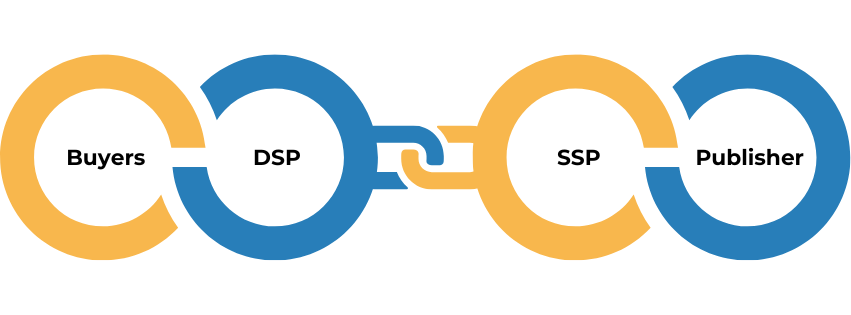

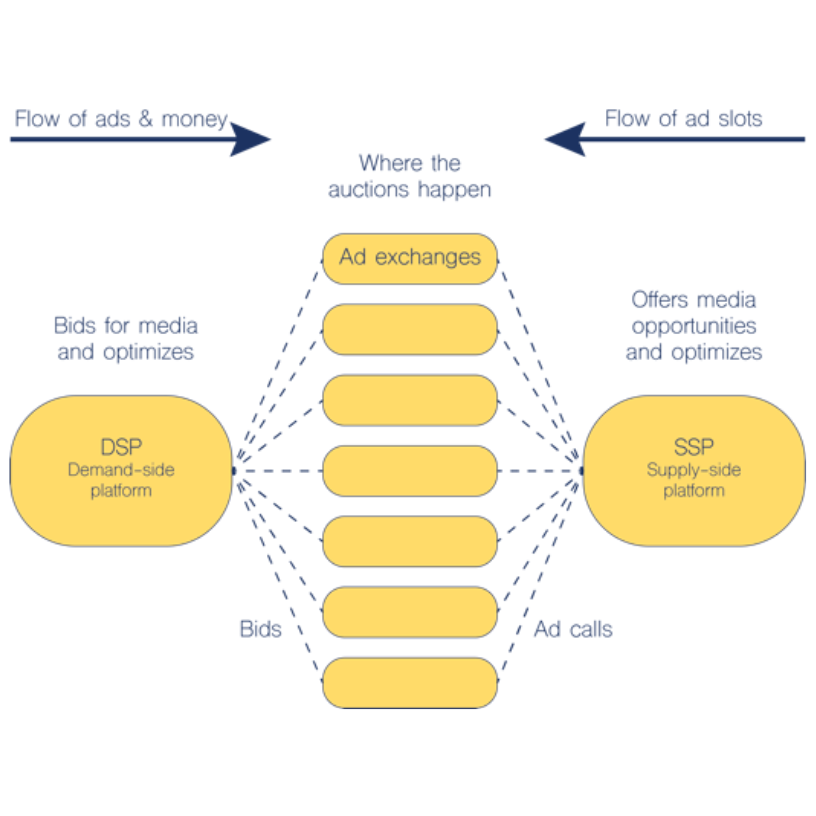

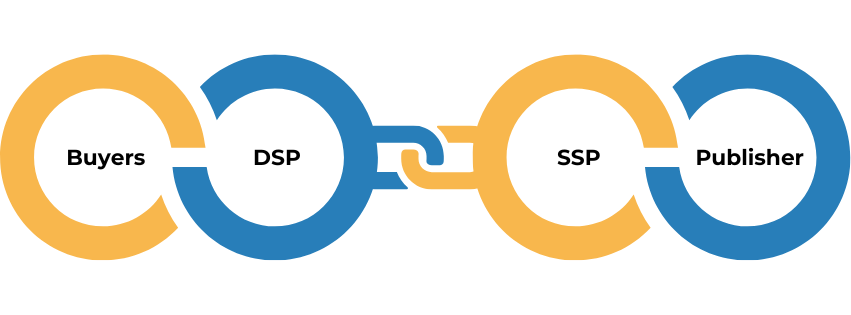

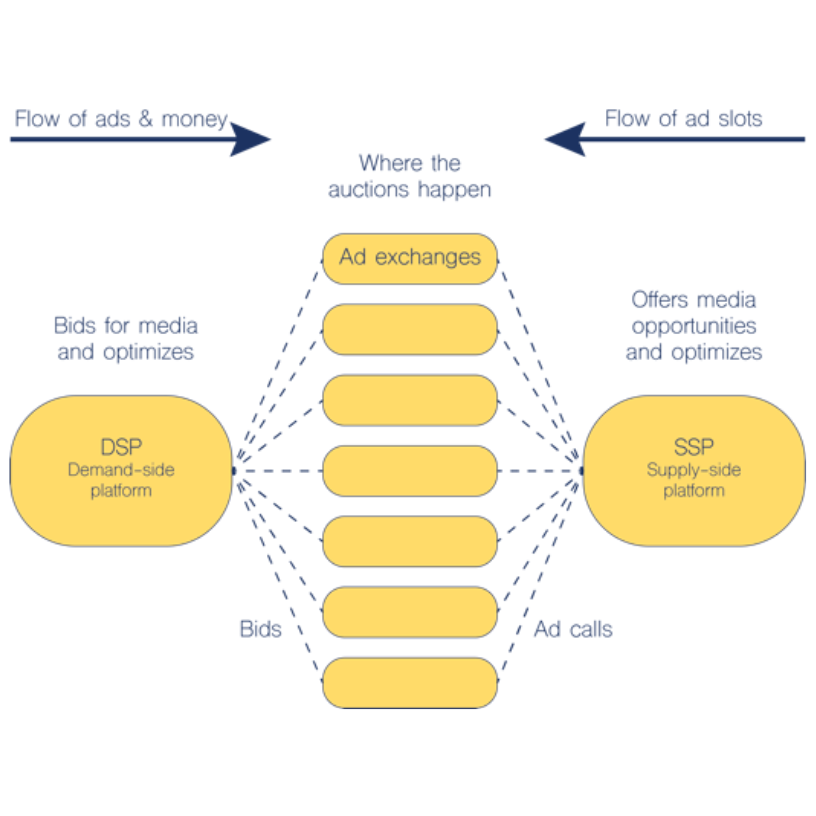

This visual is a very basic workflow of the programmatic ecosystem. To put it into more perspective lets look at each level of the workflow:

Demand Side Platform (DSP):

There are 100s of DSPs in the market. While the technology is largely the same, access to inventory can vary by platform. For example, if you want to buy Prime Video programmatically it must be done via Amazon. Another thing to consider is some DSPs are stronger in certain channels than others. (i.e. some DSPs focus on CTV, Native, Digital Out of Home, etc).

Challenge: Whether it’s walled garden O&O limited to certain DSPs or exclusive inventory/data partnerships no single DSP can do it all.

Exchanges/ Supply Side Platforms (SSP):

There are 100s of ad exchanges and/or SSPs that facilitate the transaction between ad buyer and ad seller. To make things complicated the same inventory (from a single publisher) can show up via a number of different SSPs (Supply Side Platform) across a number of ad exchanges at different rates.

Challenge: Buyers and DSPs are overwhelmed with traffic and signals. This leads to arbitrary traffic throttling at the DSP level and massive log files for media teams with little bandwidth to analyze.

Enter Curation

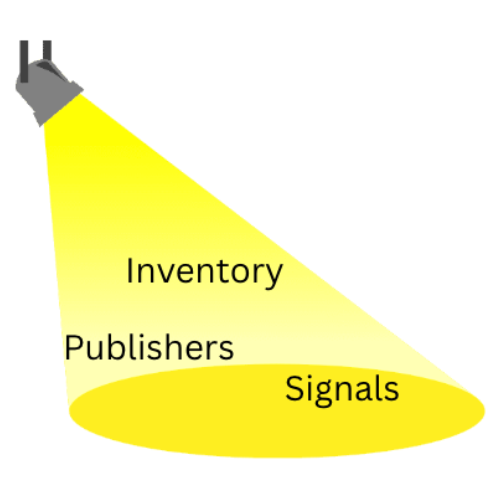

The sell side of the open web has largely been a mystery to buyers. A largely non-transparent group of exchanges, SSPs, and other intermediaries sending trillions of signals via billions of bid requests from a seemingly infinite number of publishers. That is until the supply side opened itself up to curation.

Curation in programmatic advertising refers to the process of selecting inventory and activating data through deal-based transactions. It allows media buyers to create customized inventory packages that align with their unique goals. In short, it takes your media decisioning to the supply side where it sits closer to the inventory and signals you’re bidding on.

Curation in programmatic advertising refers to the process of selecting inventory and activating data through deal-based transactions. It allows media buyers to create customized inventory packages that align with their unique goals. In short, it takes your media decisioning to the supply side where it sits closer to the inventory and signals you’re bidding on.

Now that the buy side and the sell side are linked via open platforms buyers and sellers can more efficiently bundle quality inventory and data to improve outcomes for both sides of the ecosystem. At a high level this helps solve some of the challenges currently plaguing each side of the ecosystem:

- Demand Side – An over-reliance on one size fits none platforms. Curation allows any platform with their unique inventory, data, and other insights to plug and play into any DSP making activation more portable.

- Supply Side – Buyers can now declare to the supply side what kind of traffic they want to see before their DSP bidder gets bombarded (and ultimately throttled) with queries.

Why Organizations Are Investing In Curation

The first wave of programmatic media buying was entirely focused on doing as much as possible within the DSP. With the sell side now open for business critical media decisioning can now be deployed further up the supply chain. This provides a myriad of benefits, including…

- Better Media Quality – By controlling which inventory is included in a curated deal, buyers reduce fraud, viewability issues, and wasted spend.

- Finding Alpha – Unlock value in mid to long tail publisher inventory that often slips through the cracks. Bundling this traffic with an expert curator can provide buyers with scale across valuable, lesser known publisher sources.

- Media Flexibility – Buyers that work across multiple DSPs are no longer forced to replicate their media decisioning across platforms. Deals are plug and play across all DSPs so your can literally take your activation with you.

- Improved Supply Path Transparency – Curation enables buyers to identify which SSPs and publishers perform best, helping eliminate unnecessary intermediaries and provide supply path optimization.

- More Effective Targeting – Combine your current data strategy with seller-defined audiences, contextual relevancy, and better signal efficacy for improved targeting.

- Traffic Shaping – Define the traffic you want your bidder to see; not what a throttling algorithm thinks you want to see.

- Cost Efficiency – Buyers can negotiate preferred rates with publishers or SSPs within curated deals, optimizing CPMs without sacrificing quality.

Starting Your Curation Journey

Brands, agencies, data providers, solution providers, and publishers (basically everyone in the open web ecosystem) is developing a curation strategy. No matter where your organization sits you have unique needs/goals when it comes to curation. Here is a step by step guide to help you on your curation journey.

Step 1: Build Direct Relationships With SSPs/Exchanges

A lot of buyers still rely heavily on DSP teams to sort out the supply side for them. This is a mistake. As a buyer you have unique needs and goals with your media budget. It is critical that you have a direct relationship with the exchanges and SSPs you are buying media from. Why?

A lot of buyers still rely heavily on DSP teams to sort out the supply side for them. This is a mistake. As a buyer you have unique needs and goals with your media budget. It is critical that you have a direct relationship with the exchanges and SSPs you are buying media from. Why?

You need to know “how the sausage is made.” While you can easily see the domains and apps you’re buying in a log file, do you know how the exchange/SSP is handling publisher vetting, invalid traffic, brand safety, supply path optimization, viewability, etc?

Do you know if they are ID bridging or doing anything else to enhance the bidstream data from publishers to make it more enticing to buyers? While traffic is traffic, how it’s onboarded, audited for quality, and ultimately passed on to the buy side can vary.

Another important thing to understand is their plans for the short, medium, and long term. SSPs are finally having their moment in adtech and curation is still very nascent. Everyone is rushing to get into curation and SSPs are rapidly sorting out their competitive advantages. It is vital that you understand that their product roadmap aligns with your needs.

Step 2: Define Your Curation Strategy

Now that you have an understanding of how SSPs and exchanges operate you need to determine which platform(s) best align with your needs. Until now, all of your programmatic decisioning (at least what you can control) has been happening within the DSP environment.

Now that you have an understanding of how SSPs and exchanges operate you need to determine which platform(s) best align with your needs. Until now, all of your programmatic decisioning (at least what you can control) has been happening within the DSP environment.

Deciding to move some or all of your activation strategy to new platforms is a significant change to buyer behavior that needs to be carefully planned and executed. Here are a few things you need to consider:

- How much do you plan to curate? It will be critical to understand how much of your programmatic buy will benefit from curation versus leveraging ever growing direct deal opportunities with premium publishers in the DSP.

- What are your priorities for curation? (e.g., brand safety, efficiency, data activation, premium inventory access).

- What types of inventory do you want to include? (e.g., video, CTV, high-quality display).

- What type(s) of data do you plan to activate?

- Do you have the resources to be “hands on keyboard” or do you need help from a 3rd party?

Every curation platform will have similar functionality, but they all have their own unique niches. It is vital that your curation partner(s) are aligned with your long term goals and have the capacity to meet your unique needs.

Step 3: Activate & Optimize

Now that you have chosen your partner(s) in curation here are some tips to make sure you maximize the newest layer in your in your horizontally integrated, full stack media setup:

- All or Nothing – You cannot split decisioning between the demand side and a curated deal. There are too many interoperability issues that arise. If you activate a curated PMP, all of your decisioning layer needs to be there so make sure your campaign/line item doesn’t have additional targeting parameters on the DSP side.

- Campaign Optimization – Not only has your decisioning moved up stream, your post buy analytics can be shared to further optimize deals. PMPs are no longer a “set it and forget it” proposition. You can consistently work to make them better!

- Curator Collaboration – 2025 will be the year for curators to be able to share data within data marketplaces. Don’t be afraid to engage with other curators that can pass unique data sets, inventory, etc. to you that can further augment the efficiency and effectiveness of your PMPs!

Final Thoughts

Curation is transforming programmatic advertising by allowing buyers to take control of their media supply and improve ad quality. By working with SSPs to curate inventory, your organization can gain greater transparency, improve efficiency, and ultimately drive better campaign outcomes.

If you’re curious about curation, now is the time to explore how it can fit into your media strategy. Whether you’re looking to reduce waste, enhance targeting, or improve brand safety, SSP-enabled curation is a tool everyone in the ecosystem needs in their programmatic toolkit.

Population Science can help you assess your goals and resources available to implement a curation strategy. Our insights into the various curation platforms and service providers will help you make the best decision on who to partner with. No matter where you are in your curation journey we are here to be a resource!

by Johnathan Barnes | Mar 3, 2025 | Digital Marketing, Industry News, Programmatic

People love to drop hot takes in adtech so I promise the title of this post might lean into clickbait, but I’m not predicting the end of programmatic or even the open web. I am, however, predicting how open web media is accessed will be dramatically different very soon. Many have suggested that we are in the “outcomes” era of programmatic media buying, but I think it’s more specific. Welcome to the “efficient outcomes” era!

Here are a few thoughts on the direction of programmatic and how it will make the ecosystem better for buyers.

Nobody Will Buy On Open Exchange

While many in the industry have been predicting the demise of SSPs for years, the rise of curation is providing a rebirth for the supply side. Now buyers are able to take data activation and traffic filtering closer to the impression source creating a lot of efficiencies. The implications are vast from decarbonizing our industry to improved signals in targeting. Agencies and brands will continue to rapidly adopt curation and bring in-house (either directly or via a managed service that specializes in curation).

PMP, PG, or Direct Is The Way Forward

While the supply side is having its moment, this doesn’t mean the demand side should feel threatened. In fact, the demand side has a tremendous opportunity (and duty in my opinion) to continue scaling direct deals with premium publishers. The Trade Desk has taken the lead on this and allowing buyers to have insight and access to premium inventory at scale will be a preferred way for many advertisers to buy. Finding a way to extend this opportunity to the SMB buyer is a critical piece to figure out, but many companies are entering this space.

Where the demand side and supply side might squabble is over programmatic guaranteed deals. I will be interested to see if guaranteed deals continue to grow in popularity or if they eventually get folded into the more general PMP offering from curators or if the demand side gobbles it up into a more efficient direct deal system.

Integrating The Ecosystem

While M&A has been a hot topic of late it is just a subset of a wider happening within the adtech industry; the quest to integrate the ecosystem at scale. Programmatic has historically been a very fragmented and clunky integrations have exacerbated inefficiencies across the ecosystem. Whether it is new product releases or M&A if you look closely the trend is horizontal integration across the ecosystem, not vertical.

Platforms that can offer efficiency by being able to service advertisers, DSPs, SSPs/Exchanges, and Publishers will have the power to identify and activate quality media at scale. This is even more crucial as we continue to see a desire from buyers and agencies to reduce the overall number of platforms they work with. The more you can offer, the better.

In conclusion, the “efficient outcomes” era of programmatic will bring more transparency, across fewer platform partners that are better integrated horizontally across the ecosystem. The result will be more efficiency and better outcomes for buyers and higher rewards (i.e. higher eCPMs for quality publishers). Stay tuned, the best of programmatic is yet to come!

by Johnathan Barnes | Jun 3, 2024 | Digital Marketing, Programmatic

At this point it isn’t a secret that the programmatic ecosystem has done an abysmal job with brand safety and supply quality. It also is pretty clear that The Trade Desk is doing whatever it can to distance themselves from the DSP pack. While The Trade Desk is clearly a Tier 1 DSP it’s hard to take market share away from their competitors who all own and operate premium inventory and data.

The Trade Desk has invested a lot into Universal ID2 to put themselves at the forefront of the post-cookie audience targeting solutions. While it’s too soon to write off UID2 it seems pretty clear that it will not achieve the scale needed to make them the “go to” for post-cookie identity. Now, it appears they are taking another shot at differentiating themselves from their other Tier 1 DSP competitors.

The new PR push is pretty straightforward. They want to brand themselves as the arbiters of “the premium open web.” The timing makes sense because brands and agencies are scrambling to figure out ways to ensure brand safety and supply quality in the wake of numerous reports highlighting how DV, IAS, and the like have been asleep at the wheeling certifying quality. The Trade Desk has released SP500+ (which seems to be an index of top, premium publishers) and more recently the Top 100 publishers.

These lists are not any kind of innovation in themselves. In fact, many on adtech Twitter (or X) chided the move as a SLAAP (site list as a service) and I essentially agree. Any programmatic media buyer with a few years of experience probably could have put a nearly identical list together. That said, something bigger is likely going on. It appears the Top 100 publisher list is full of UID2 adopters. The Trade Desk could be trying to bully the open web into their ecosystem of UID2 or else be branded “non-premium” inventory.

If this is the case I think it’s a dangerous path for The Trade Desk to take. Publishers are tired of being pushed around by monopolistic players on the buy side. Further, The Trade Desk has spent a lot of effort creating goodwill in the programmatic ecosystem around not being their competition. Attempting to use their clout in the industry to start pushing their view of the world on publishers and the rest of the programmatic ecosystem players could ultimately backfire. I don’t think the industry as a whole wants or needs a DSP to declare what is and is not the premium open internet.

No matter what The Trade Desks true intentions are with these publisher lists one thing is certain. We will be very interested to see where they go with all of this.

by Johnathan Barnes | Jun 3, 2024 | Digital Marketing, Programmatic

As the hopes and dreams of a truly open internet come crashing down around the adtech industry, is there any chance that a truly independent ecosystem can not only survive, but thrive in an era of privacy, walled gardens, and domination by a handful of key players? I believe there is.

To be successful we as an industry need to beat the walled gardens at their own game. It will entail leveraging the interconnected ecosystem of agencies/buyers, platforms, and publishers to scale a walled garden experience in an open, programmatic environment. While it sounds challenging, the foundation for achieving this is already in place. We need all of the key players from the buy and sell side to collaborate on curation.

Here are three ways this can happen:

- The walled gardens need to understand the value of programmatic media buying. As Amazon continues to garner more market share and players like Yahoo and The Trade Desk create more premium, exclusive deals around O&O (or 3rd party O&O) the stranglehold that the duopoly of Google and Meta is slowly being chipped away. Advertisers understand there is a vast network of high quality inventory to be bought across multiple channels outside of

- The supply side (i.e. SSPs) needs to focus their efforts not on creating competing DSPs, but rather partnering with buy side players (agencies, in-house teams, data providers, and other solutions) to curate customized networks that aggregate premium data that can prove top of funnel value by starting customer journeys that end with conversions. Basically, the SSP of the future is the curated ad network of the past. However, instead of competing directly for advertiser dollars the opportunity to even better collaborate with DSPs that already have the advertiser budgets will grow immensely as SSPs create more value for every niche on the buy side.

- The adtech industry as a whole needs to stop focusing on scale and more on value. For every advertiser and every tactic there is a point where incremental spend provides a negative ROI. Adopting a focus on value alone will go a long way in eliminating MFA and other types of fraud from the ecosystem and raise CPMs on the quality inventory that is out there. Everybody wins!

Do I think all three of these things will happen overnight? No. In fact, I think it will take a long time for #1 to happen. If the adtech industry can actually come together, focus on #2 and #3, and stop fighting useless turf wars we can force the walled gardens back into the programmatic ecosystem. It’s time to call a ceasefire and admit that it will take all of us (agencies, in-house teams, DSPs, SSPs, data providers, publishers, and other solutions), working together, with SSPs as the new ad networks, to create a better, curated ecosystem that provides value to every advertiser.

Why Is The Open Web So Complex?

Why Is The Open Web So Complex?

A lot of buyers still rely heavily on DSP teams to sort out the supply side for them. This is a mistake. As a buyer you have unique needs and goals with your media budget. It is critical that you have a direct relationship with the exchanges and SSPs you are buying media from. Why?

A lot of buyers still rely heavily on DSP teams to sort out the supply side for them. This is a mistake. As a buyer you have unique needs and goals with your media budget. It is critical that you have a direct relationship with the exchanges and SSPs you are buying media from. Why? Now that you have an understanding of how SSPs and exchanges operate you need to determine which platform(s) best align with your needs. Until now, all of your programmatic decisioning (at least what you can control) has been happening within the DSP environment.

Now that you have an understanding of how SSPs and exchanges operate you need to determine which platform(s) best align with your needs. Until now, all of your programmatic decisioning (at least what you can control) has been happening within the DSP environment.